The ADA Tax Credit – Impulse®

Leverage government programs & grow your practice!

Savvy practitioners leverage tax credits to maximize practice potential.

While the purchase of an Impulse® or IQ® adds unique differentiation to the overall practice making you more attractive to a wider patient population, these instruments also qualify for the ADA tax credit because it allows you to adjust patients who may be immobile, or confined to a wheelchair.

There has never been a better time to take full advantage of this program.

Key Points:

ADA Tax Credit Applied to Impulse® & Impulse IQ®

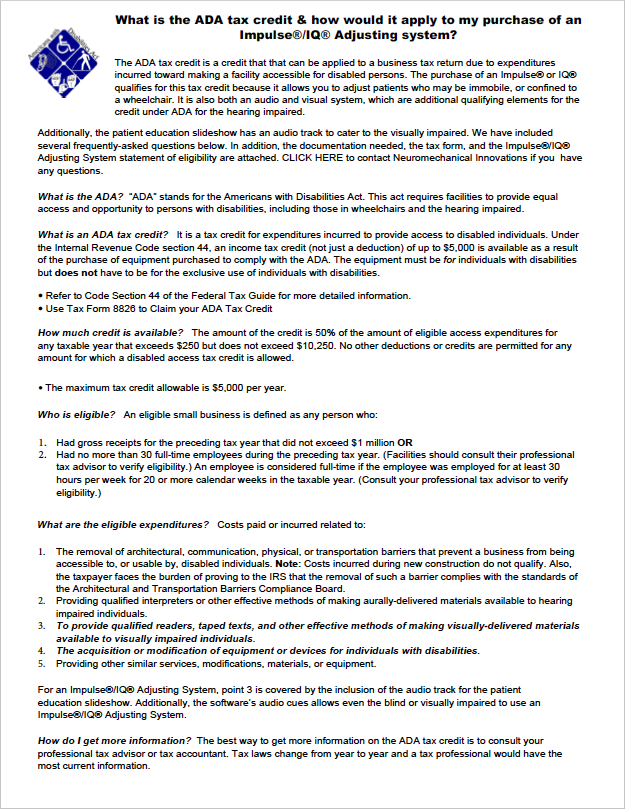

ADA?

“ADA” stands for the Americans with Disabilities Act. This act requires facilities to provide equal access and opportunity to persons with disabilities, including those in wheelchairs and the hearing impaired.

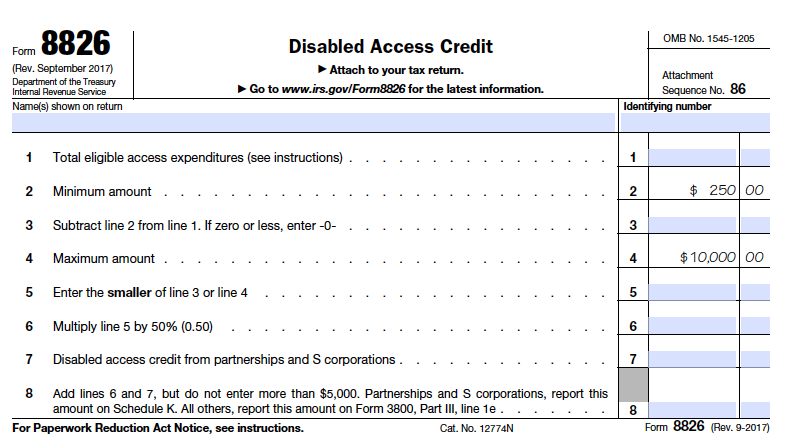

ADA tax credit?

A tax credit for expenditures incurred to provide access to disabled individuals.

How Much Can I Get?

Under the Internal Revenue Code section 44, an income tax credit (not just a deduction) of up to $5,000 (money in your pocket) this year.

What Are The Qualifications?

You qualify when purchasing equipment that enables treatment of individuals with disabilities. Equipment does not have to be for the exclusive use of individuals with disabilities.

Tax Advice.

The best way to get more information on the ADA tax credit is to consult your professional tax advisor or tax accountant.

Tax Credit vs. Deduction (Understanding The Math VIDEO)

Resources

Other Tools & Resources

Reach Us

World Headquarters

783 County Route 3

Fulton, NY 13069

Sales & Service

101 S Roosevelt Avenue

Chandler • AZ • 85226

480.785.8448

888.294.4750

Repair & Service Issues: Please click HERE for the return and repair portal.